Tax relief 2012 2013

For more recent rates, see Tax relief.

Tax Relief describes a situation in which an individual or company's liability to tax is reduced as a result of an entitlement to claim allowances or offset certain permitted expenditures against income.

Contents |

[edit] Individuals

Individuals are entitled to personal allowances which provide tax relief by reducing taxable income. They can also obtain tax relief if they are able to utilise other allowances which HM Revenue and Customs permit in certain circumstances.

[edit] Personal Allowances

These are set by HM Government and usually change each financial year to take account of changes in the cost of living. From time to time however these allowances may remain unchanged for a longer period of time. Depending upon the particular circumstances of each individual, the amount of the allowance is free from assessment to tax. The level of personal allowance depends upon age and also income.

For 2012/13 Personal Allowance:

- under 65 years of age £8,105

- 65 - 74 £10,500

- 75 and over £10,660

If an individual's income exceeds £100,000 the amount of the allowance reduces by £1 for every £2 income exceeds £100,000. Thus it can be seen that at an income level of £116,210 the allowance for an individual under 65 disappears completely. Equally the higher allowances for older individuals are gradually reduced in much the same way as is the case for the basic personal allowance above £100,000. For 2012/13 the age related allowances begin to reduce at a rate of £1 for every £2 of earnings above £25,400 per annum. Married Couples Allowance of £7,705 (for 2012/13) is available where one partner is at least 75 years of age in the financial year in question. Married Couples Allowance provides tax relief at 10% thus reducing tax payable by £770.50.

[edit] Pension Contributions

Individuals may obtain tax relief by contributing to personal or occupational pensions schemes with a view to building up a fund to provide income in retirement. Contributions made in this way entitle the individual to tax relief at their marginal rate of tax. For a 40% taxpayer therefore, tax relief of £20,000 may be obtained against a contribution of £50,000.

There are detailed rules and limits governing pension schemes and amounts that may be contributed, more details of which are available from HM Revenue and Customs.

[edit] Gift Aid/Deeds of Covenant

Tax relief is available to support charitable giving. For a U.K. taxpayer the amount of the gift is deemed to be net of basic rate tax. In "grossing up" the value of the gift, relief is obtained at the taxpayers marginal rate. At the same time, the recipient of the gift can reclaim the basic rate of tax deducted at source.

[edit] Enterprise Investment Schemes (EIS)

Tax relief is also available to individuals who are prepared to invest in new businesses. The EIS pemits relief of 30% on the investment into shares in approved companies upto a maximum of £500,000. Thus maximum tax relief of £150,000 is available if the investor has sufficient taxable income against which the EIS relief can be set. There is also a carry - back provision which permits the tax relief to be set against income tax liability arising in the tax year immediately prior to the year in which the share acquisition is effected. Shares must be held for a mnimum of three years otherwise the tax relief granted will be withdrawn.

[edit] Companies

Companies and non-incorporated businesses obtain tax relief by setting business running costs against income. They can also obtain relief by claiming capital allowances when they purchase assets for use in their businesses.

[edit] Find out more

[edit] Related articles on Designing Buildings Wiki

- Budget.

- Capital allowances.

- Business case.

- Business plan

- Business rates.

- Cashflow.

- Cash flow forecast.

- Financial management tools.

- Funding options.

- Housing Grants, Construction and Regeneration Act.

- PAYE.

- Research and development tax relief.

- Scheme for Construction Contracts.

- Tax relief.

- VAT

- VAT - Option to tax (or to elect to waive exemption from VAT).

- VAT - Protected Buildings.

Featured articles and news

RTPI leader to become new CIOB Chief Executive Officer

Dr Victoria Hills MRTPI, FICE to take over after Caroline Gumble’s departure.

Social and affordable housing, a long term plan for delivery

The “Delivering a Decade of Renewal for Social and Affordable Housing” strategy sets out future path.

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

The proposed publicly owned and backed subsidiary of Homes England, to facilitate new homes.

How big is the problem and what can we do to mitigate the effects?

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.

Architectural Technologist CPDs and Communications

CIAT CPD… and how you can do it!

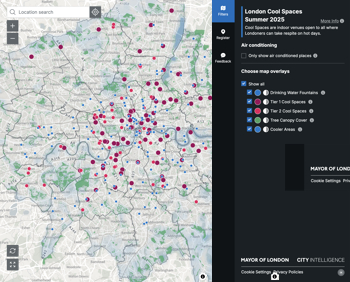

Cooling centres and cool spaces

Managing extreme heat in cities by directing the public to places for heat stress relief and water sources.

Winter gardens: A brief history and warm variations

Extending the season with glass in different forms and terms.

Restoring Great Yarmouth's Winter Gardens

Transforming one of the least sustainable constructions imaginable.

Construction Skills Mission Board launch sector drive

Newly formed government and industry collaboration set strategy for recruiting an additional 100,000 construction workers a year.

New Architects Code comes into effect in September 2025

ARB Architects Code of Conduct and Practice available with ongoing consultation regarding guidance.

Welsh Skills Body (Medr) launches ambitious plan

The new skills body brings together funding and regulation of tertiary education and research for the devolved nation.

Paul Gandy FCIOB announced as next CIOB President

Former Tilbury Douglas CEO takes helm.

UK Infrastructure: A 10 Year Strategy. In brief with reactions

With the National Infrastructure and Service Transformation Authority (NISTA).